Volunteer Income Tax Assistance (VITA)

Self-Certifiers:

Volunteers will complete certification on their own. Volunteers will receive a check-in call, text or email periodically.

Please register here if unable to attend In-Person training and will commit to use the Online Resources to complete your certifications. Various Online links are below for your convenience. Feel free to contact us for any guidance.

VITA/TCE Central Page: https://www.linklearncertification.com/d/

Proceed to the Subject dropdown area to select your tests.

The first test would be your VSOC, Volunteer Standards of Conduct.

The second test would be your Intake Interview & Quality Review.

The third would be your Certification level (Basic or Advanced).

Note well. Volunteers can go directly to the Advanced level. There is no need to do the Basic level first. You will have 2 chances to pass each test. The passing score is 80%. If you did not succeed on the first try, please reach out to us before making your 2nd attempt.

We would like you to have your certifications ready for us by January 24, 2026.

The tests questions are exactly the same you will see Online at the Testing site as in the blue Test booklet 6744.

Study guide/s: Please use these.

Basic: Study Guide BASIC TY2025 in 2026.pdf - Google Drive

Advanced: Study Guide Advanced TY2025 in 2026.pdf - Google Drive

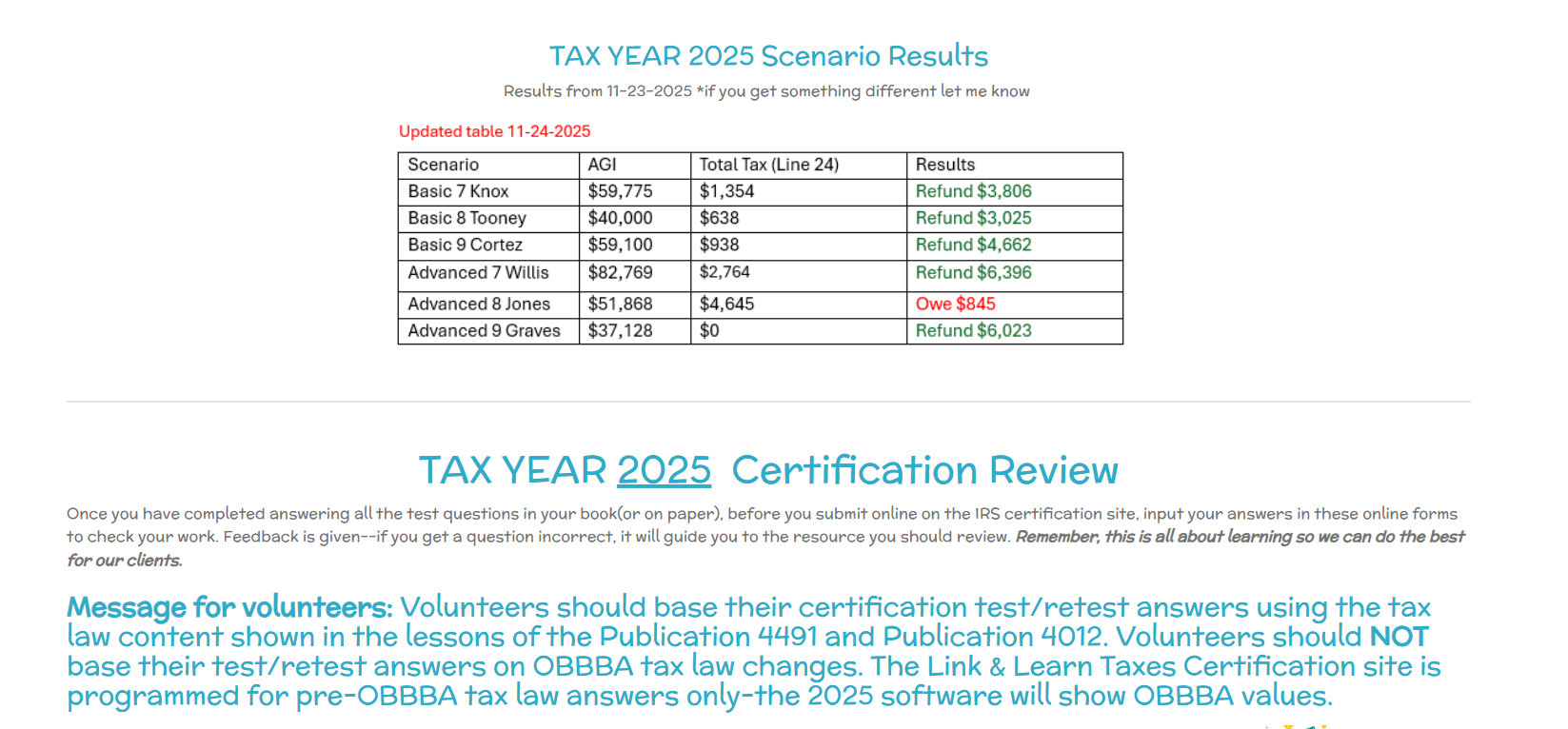

Practice Lab returns outcomes: Tax Year 2025 Scenarios results for the Practice Lab returns.

___________________________________

2025 Tax Year: Online Resources

Publication 4491: https://www.irs.gov/pub/irs-pdf/p4491.pdf

Publication 4012: https://www.irs.gov/pub/irs-pdf/p4012.pdf

Publication 6744: https://www.irs.gov/pub/irs-pdf/f6744.pdf

______________________________________________

VITA/TCE Central Page: https://www.linklearncertification.com/d/

OR Google search for “Link Learn”

PRACTICE LAB

Create/Set up (New Volunteers), or Access an existing account (Prior VITA Volunteers) in Practice Lab for tax return practice: https://vita.taxslayerpro.com/IRSTraining/en/Account/Access:

Practice Lab is located under the Quick Links

· Password: TRAINPROWEB (case sensitive) Generic Password Access for all volunteers

· Program: VITA.

· SIDN (leave blank)

· Proceed to set up your account. (write these down)

___________________________________________

**Additional Online Study Resources: United Way VITA Resources Collaboration Learning.

This site is interactive with video lessons and exercises.

https://www.vitaresources.net/

____________________________________________

Best,

Charmaine

Rodriguez | VP Financial Stability | United Way of Central Jersey

32 Ford Avenue, Milltown, NJ 08850 | Tel: 732-247-3727 Ext 216

www.uwcj.org Email: crodriguez@uwcj.org

_____________________________________

Millions of low-to-moderate-income taxpayers rely on free, basic tax preparation each year, and thousands of ordinary VITA volunteers like you prepare these returns! The United Way of Central Jersey (UWCJ) needs you on its tax prep team for 2026!

Last season 148 volunteers including 85 students (college and high school) were among our certified preparers that participated in this critical asset-building engagement. Collectively over 4,000 returns were prepared. The results - Over $2.5 million in refunds returned to taxpayers in the community in the form of credits and refunds. Volunteers saved taxpayers collectively over $600,000 in tax preparation fees.

United Way of Central Jersey teams up with the IRS and community partners each year to provide free tax services through VITA. United Way and its collaborators are the leading providers of volunteer income tax assistance in Middlesex County.

"This service is aimed at low and moderate-income taxpayers," said Gloria Aftanski, President of United Way of Central Jersey.

The IRS partners with United Way to direct a coalition of community partners in order to increase the reach of the VITA.

The Middlesex County, NJ VITA Coalition is recruiting new/additional volunteers in various capacities to help with this effort. Volunteers must complete certification timely and be ready to start by February 1, 2026, through April 30, 2026.

United Way of Central Jersey is located at 32 Ford Avenue in Milltown NJ 08850

Certifications requirements:

Ethics Certification

Intake/Interview & Quality Review Certification

Advance Level Certification